Hey readers, you are welcome to Marketmoved. This article will present you with some interesting Finviz news. Our site is regularly updated in order to keep you posted and acquainted with the trends within the Finviz platform.

Here are the available news:

1. Tesla Has $1.2 Billion at Risk in Trump Tax Bill

According to Bloomberg, an all-but-doomed tax credit highlights just how much Elon Musk’s most significant business has to lose under President Donald Trump.

Trump’s massive tax bill would essentially eliminate a credit worth as much as $7,500 for buyers of some Tesla Inc. models and other electric vehicles by the end of 2025, seven years ahead of schedule. That would translate to a roughly $1.2 billion hit to Tesla’s full-year profit, according to JPMorgan analysts.

After leaving his formal advisory role in the White House last week, Musk, Tesla’s chief executive officer, has been on a mission to block the president’s signature tax bill that he described as a “disgusting abomination.” The world’s richest man has been lobbying Republican lawmakers, including making a direct appeal to House Speaker Mike Johnson, to preserve the valuable EV tax credits in the legislation.

Tesla’s business is under regulatory threat somewhere. Separate legislation passed by the Senate attacking California’s EV sales mandates poses another $2 billion headwind for Tesla’s sales of regulatory credits, according to JPMorgan.

Taken together, those measures threaten roughly half of the more than $6 billion in earnings before interest and taxes that Wall Street expects Tesla to post this year, analysts led by Ryan Brinkman said in a May 30 report.

Tesla didn’t immediately respond to a request for comment.

The House-passed tax bill would aggressively phase out tax credits for the production of clean electricity and other sources years earlier than scheduled. It also includes stringent restrictions on the use of Chinese components and materials that analysts said would render the credits useless and limit the ability of companies to sell the tax credits to third parties.

Tesla’s division, focused on solar systems and batteries separately, criticised the Republican bill for gutting clean energy tax credits, saying that “abruptly ending” the incentives would threaten US energy independence and the reliability of the power grid.

The clean energy and EV policies under threat were enacted mainly as part of former President Joe Biden’s Inflation Reduction Act. The law was designed to encourage companies to build a domestic supply chain for clean energy and electric vehicles, giving companies more money if they produce more batteries and EVs in the US. Tesla has a broad domestic footprint, including car factories in Texas and California, a lithium refinery and battery plants.

With those Biden-era policies in place, US EV sales rose 7.3% to a record 1.3 million vehicles last year, according to Cox Automotive data.

2. Analyst who Nailed Tesla’s Collapse Has a New Prediction as Musk Turns Bearish

Analyst who nailed Tesla’s collapse has a new prediction as Musk turns bearish originally appeared on TheStreet.

In August 2022, crypto investor and expert Tuur Demeester made a bold call: sell Tesla (TSLA), buy Bitcoin. At the time, it may have seemed contrarian. But 5 months later, the trade proved golden.

“It was indeed a good time to swap one for the other,” Demeester posted on Jan. 4, 2023. “TSLA lost 53% against BTC in 5 months.”

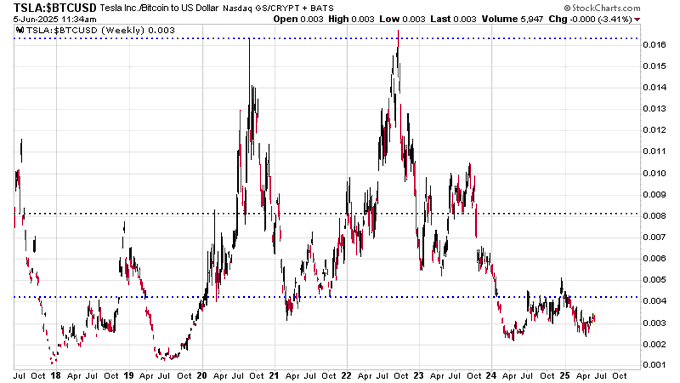

Now, nearly two years after his original post, Demeester is revisiting the chart. “Is it time to get back into TSLA, with Elon being super bearish on the US dollar?” he wrote on June 5, sharing an updated long-term ratio chart between Tesla and Bitcoin.

As per Kraken’s price feeds, Bitcoin is up 11.6% over the past 30 days and 47.9% over the past year. The asset hit an all-time high of $111,814 on May 22, 2025, and is currently trading around $104,902, down about 6.2% from that peak.

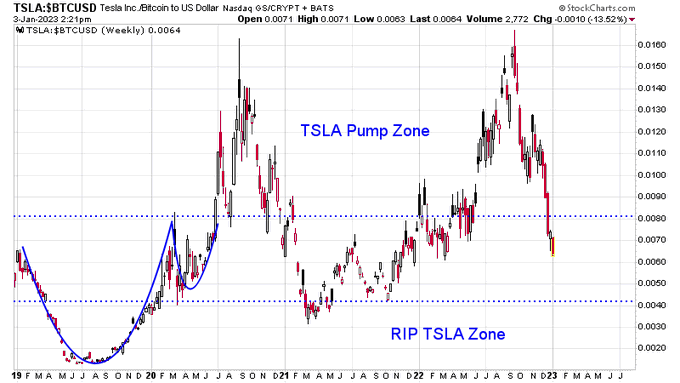

The Chart that Called it All

Demeester’s annotated charts show Tesla’s value measured in Bitcoin — a view only seasoned crypto traders tend to track. In early 2020, TSLA began its parabolic run, outperforming Bitcoin significantly and entering what he called the “TSLA Pump Zone.”

But by mid-2022, the ratio peaked and began a sharp descent. The zone he had once dubbed “RIP TSLA” wasn’t a joke — Tesla’s BTC ratio plunged from over 0.015 to just 0.003 as of June 2025.

In this context, the ratio (TSLA: BTC) tells you how many Bitcoins you could buy with one share of Tesla stock. It’s a way of comparing Tesla’s performance directly against Bitcoin, rather than just looking at their dollar prices. If the ratio rises, Tesla is gaining value faster than Bitcoin. If it falls, Bitcoin is outperforming Tesla.

His final chart, shared this week, shows the ratio bottoming out again. It’s the lowest it’s been since late 2019, with Tesla now worth just 0.3% of a Bitcoin per share, down over 80% from its peak in BTC terms.

Macro Risk Collides with Technical Lows

At the same time Demeester’s chart hits rock bottom, Tesla is facing fresh macro threats. JPMorgan analyst Ryan Brinkman believes Donald Trump’s proposed “One Big Beautiful Bill” could deal a multibillion-dollar blow to Tesla’s earnings.

“The legislation would get rid of the $7,500 federal tax credit EV buyers receive, resulting in a $1.2 billion (19% of its EBIT) headwind,” Brinkman said. He also warned Tesla could lose access to California’s ZEV regulatory credits — a move that could have added another $2 billion in losses last quarter.

Musk, once Trump’s pick to run the Department of Government Efficiency, isn’t pleased either. “It increases the budget deficit… and undermines the work that the DOGE team is doing,” he said last week.

‘Is it Time to Rotate Back into Tesla?’

With political uncertainty, Fed rate pressure, and Musk’s robotaxi gamble all in play, TSLA still faces serious headwinds. But if Bitcoin starts to cool off — or if the EV giant pulls off a surprise earnings beat — Demeester’s ratio chart could signal a rare re-entry point.

3. Trump Gets His Call With Xi. The Two Sides Agreed to Keep Talking

President Donald Trump got the call with Chinese leader Xi Jinping he has been wanting since a trade truce struck between the two countries in mid-May unravelled last week.

Though it is not clear whether the latest interaction between the two economic rivals will bring much calm.

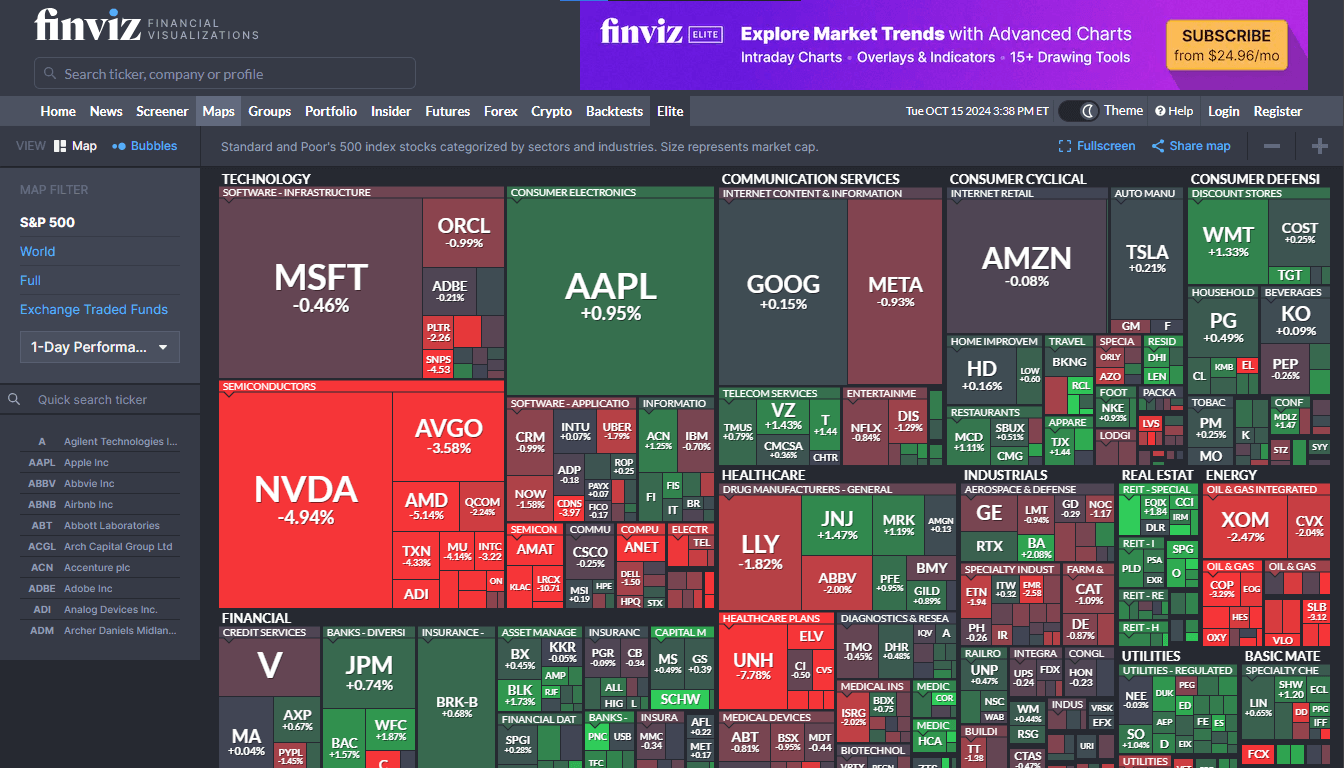

4. Analyst Says Tesla (TSLA) ‘Great AI Story on Planet’ Despite ‘Losing Money On Cars’

Tesla (TSLA) shares are trending as Elon Musk is openly grilling President Donald Trump’s tax bill plan. The stock is down 12% this year.

Jeffrey Small from Arbour Financial talked about Tesla (TSLA) during a recent program on the Schwab Network. He believes AI and autonomous driving remain the key to Tesla’s growth.

“Granted, they’re losing money on their cars. That number is growing, but you can’t ignore that they are the greatest AI story on the planet. Self-driving robo taxis, if they take hold and he can master that, have an 80% margin in an environment where he can take over the taxi industry. And if that occurs, that’s why the price is up. It’s going up. It bottomed out at 221 on April 2nd. It’s up to 361 today. That’s the only reason the stock is going up at this point, because it certainly isn’t going up because of the auto business.”